Best Lawyers in Bangalore for Cheque Bounce Cases

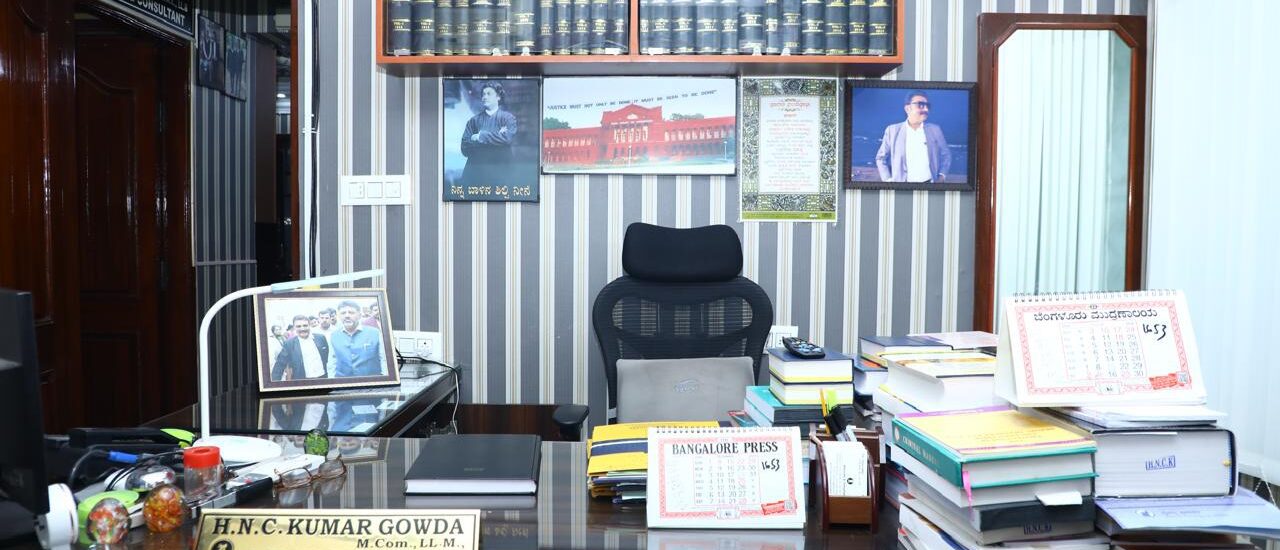

In today’s fast-paced financial world, cheque bounce cases have become increasingly common, causing stress and financial uncertainty for individuals and businesses alike. If you’re in Bangalore and facing a cheque bounce issue, you need reliable legal guidance to safeguard your interests. At HNCK and Associates, we specialize in handling Best Lawyers in Bangalore for Cheque Bounce Cases with professionalism and a client-centric approach.

This blog delves into everything you need to know about cheque bounce cases, including their causes, legal implications, and how the expert lawyers at HNCK and Associates can help you resolve such disputes effectively.

What is a Cheque Bounce Case?

A cheque bounce occurs when a cheque issued by an individual or entity is returned unpaid by the bank due to insufficient funds, mismatched signatures, or other discrepancies. Such cases often escalate into legal disputes under Section 138 of the Negotiable Instruments Act, 1881, which deals with dishonored cheques.

Cheque bounce cases can cause severe financial loss and damage reputations. To ensure your rights are protected, seeking legal advice from the best lawyers is critical.

Common Reasons for Cheque Bouncing

Insufficient Funds

One of the most frequent reasons, this occurs when the issuer’s account lacks sufficient balance to honor the cheque amount.Mismatched Signature

A signature mismatch between the cheque and the bank records can lead to a dishonor.Stale Cheques

Cheques presented after their validity period (typically three months) are rejected by banks.Overwriting or Alteration

Visible alterations or overwriting on a cheque can result in its dishonor.Account Closure

A cheque issued from a closed account will automatically bounce.Incorrect Details

Errors in writing the payee’s name, amount, or date can also lead to a cheque bounce.

At HNCK and Associates, our lawyers investigate the root cause of the cheque dishonor and develop a strategic approach to tackle the legal implications effectively.

Legal Implications of a Cheque Bounce

Under Section 138 of the Negotiable Instruments Act, cheque bouncing is considered a criminal offense. The key elements of this law include:

Notice Period

Upon receiving a dishonored cheque, the payee must send a written notice to the issuer within 30 days, demanding payment.Liability

If the issuer fails to comply within 15 days of receiving the notice, legal proceedings can be initiated.Punishment

The penalties for cheque bounce include:- Imprisonment up to two years.

- A fine equivalent to twice the cheque amount.

Our expert lawyers at HNCK and Associates have an in-depth understanding of these legal procedures and ensure that every step is executed meticulously.

How HNCK and Associates Can Help You

At HNCK and Associates, we pride ourselves on being one of the most trusted legal firms in Bangalore for cheque bounce cases. Here’s why clients prefer us:

1. Experienced Legal Team

Our team of seasoned lawyers has successfully handled numerous cheque bounce cases, ensuring favorable outcomes for our clients.

2. Tailored Legal Strategies

Every case is unique, and so is our approach. We craft personalized legal strategies to suit the specific needs of our clients.

3. Timely Filing of Cases

We ensure that all complaints and legal notices are filed within the stipulated time to avoid complications.

4. Court Representation

Our lawyers represent clients effectively in both lower courts and higher judicial forums, ensuring a strong defense.

5. Alternative Dispute Resolution

Whenever possible, we help clients resolve disputes amicably through mediation or negotiation, saving time and resources.

6. Regular Updates

Transparency is at the core of our services. We keep clients informed about the progress of their cases every step of the way.

Types of Cheque Bounce Cases We Handle

At HNCK and Associates, we cater to a wide range of cheque bounce cases, including:

1. Personal Cheque Bounce Cases

If you’ve issued or received a personal cheque that has bounced, our lawyers will assist in initiating or defending legal action.

2. Business Cheque Bounce Cases

Businesses often deal with cheque bounce disputes involving vendors, customers, or partners. We help protect your company’s interests with effective legal solutions.

3. Post-Dated Cheques

Disputes arising from post-dated cheques often require specialized handling. Our team ensures that your rights are upheld in such cases.

4. High-Value Cheque Disputes

Cases involving high-value cheques can escalate quickly. Our experienced lawyers handle such disputes with precision and care.

Steps Involved in a Cheque Bounce Case

1. Sending a Legal Notice

The first step is to send a formal legal notice to the cheque issuer, demanding payment.

2. Filing a Complaint

If the issuer fails to comply, a criminal complaint is filed under Section 138 of the Negotiable Instruments Act.

3. Court Proceedings

The case is presented in court, where evidence and arguments are put forth by both parties.

4. Judgment

The court delivers its verdict based on the evidence and arguments presented.

Our lawyers at HNCK and Associates guide you through every stage of this process, ensuring a smooth and stress-free experience.

Why Choose HNCK and Associates?

1. Unmatched Expertise

With years of experience, our team is well-versed in the intricacies of cheque bounce laws in India.

2. Client-Centric Approach

We prioritize our clients’ needs and work tirelessly to achieve the best possible outcomes.

3. Affordable Services

Our legal services are competitively priced, making quality representation accessible to all.

4. Proven Track Record

We have a history of successfully resolving complex cheque bounce cases for individuals and businesses in Bangalore.

Conclusion

Cheque bounce cases can be challenging and time-sensitive. With expert legal representation from HNCK and Associates, you can rest assured that your case will be handled with professionalism and diligence.

Whether you’re an individual or a business, our team of skilled lawyers in Bangalore is here to provide comprehensive legal support for all cheque bounce matters. Contact HNCK and Associates today for a consultation and take the first step toward resolving your cheque bounce dispute.